Getting My Do I Have To List All My Debts When Filing Bankruptcy in Virginia To Work

The largest downside to this chapter? It can be highly-priced. Many people won't be able to afford to pay for the month to month payment.

Fraudulent or intentional tort debts are topic to your discharge obstacle court demo named an adversary continuing which will establish whether or not the credit card debt is dischargeable in bankruptcy.

A lot of people who want to leave debts out aren’t felony masterminds with evil intentions. They’re just wanting to stay away from a headache or conserve Everybody some time.

Everyone knows that seeing the forest aids us understand the trees. In the same way, knowing the numerous techniques you will take all through your bankruptcy journey will assist you to realize the bankruptcy course of action. Think of this checklist as being a roadmap to track your development.

However, credit history can endure if the individual continues to operate up bank card balances once again or pass up payments. What is the best credit card debt consolidation Resolution?

In summary, a client is necessary to list all their creditors of their bankruptcy petition. If a purchaser excludes a creditor within the bankruptcy petition, they may still be responsible for repaying the debt beyond the bankruptcy situation.

Add all gross money acquired throughout the very last six months and multiply it by two. Evaluate the determine towards the money charts about the U.S. Trustee's Web page (find "Usually means Testing Information and facts").

The sole big difference click here to find out more is the fact in Chapter thirteen, the marital adjustment is utilized in the first Element of the form. In Chapter 7, it’s only used in the second Component of the form.

Also, not like Chapter 13, Chapter redirected here 7 has no payment strategy choice for catching up on late go to my blog home finance loan or auto payments. So you can get rid of your property or vehicle for anyone who is powering around the financial loan when you file.

topdebtconsolidationloans.com normally takes your privacy extremely seriously. We support the CCPA by making it possible for California residents to opt outside of any potential sale in their personalized info. If our website you want to to history your desire that topdebtconsolidationloans.

The knowledge on This page isn't provided by any state Business but like a usefulness to state residents with backlinks to state and federal hardship help for informational functions only.

And - even though most within your financial debt is erased through a bankruptcy filing, you'll commonly nonetheless owe 100% of your respective student bank loan credit card debt and taxes.

Almost all of the leftover financial debt will likely be forgiven. That has a Chapter thirteen bankruptcy, the court will buy you to definitely Dwell inside a spending plan for around five many years, in which period most of one's personal debt might be repayed. check out this site Either way, creditors will quit calling and you can start getting your fiscal daily life again so as.

That said, you have for being latest in your property finance loan payments when you file your bankruptcy scenario. Or else, the bank usually takes your house back, irrespective of the exemption.

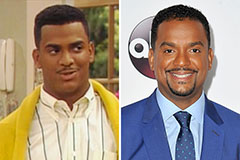

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!